Technological advancements are reshaping traditional practices and revolutionising how insurers operate across various domains. Here’s how IT innovations are driving significant transformations in the insurance industry.

Key takeaways from this article

- Synthetic data can effectively increase savings and reduce costs

- AI-driven digital technology is key to increasing customer satisfaction and personalising services

- Advanced machine learning algorithms prevent false claims worth millions of dollars each year

Synthetic Data for Automated Underwriting Systems potentially lead to cost reductions of 30%

Why choose synthetic data?

A scarcity of valuable data leads to inaccurate analytical results and raises the risk of making inaccurate business decisions. Synthetic data fills in the gaps in real data while guaranteeing the protection of customer privacy and improving the training process of AI models. This makes it possible to make better strategic decisions, improve operational efficiency, and adapt faster to changing market conditions.

Discover the potential hidden in synthetic data

Synthetic data, generated through advanced machine learning algorithms, is emerging as a game-changer in underwriting processes. By replicating real-world scenarios while safeguarding customer privacy, insurers can train AI models more effectively, leading to enhanced decision-making and scalability. Studies suggest that implementing AI-driven underwriting solutions potentially leads to cost reductions of up to 30% in operational expenses, translating to potential annual savings of millions of dollars for large insurers.

Britenet designed and developed a custom system to help an insurance company manage a new side of their business. They implemented a reporting and analysis process and designed a customer portal. They maintained ownership of their work throughout the project.

Bartosz Okrasa – Chief Financial Officer

Towarzystwo Ubezpieczeń Wzajemnych

Use Digital Assistants and Natural Language Processing (NLP) to improve efficiency gains to €1,000 per policy

Use AI to get closer to your customers

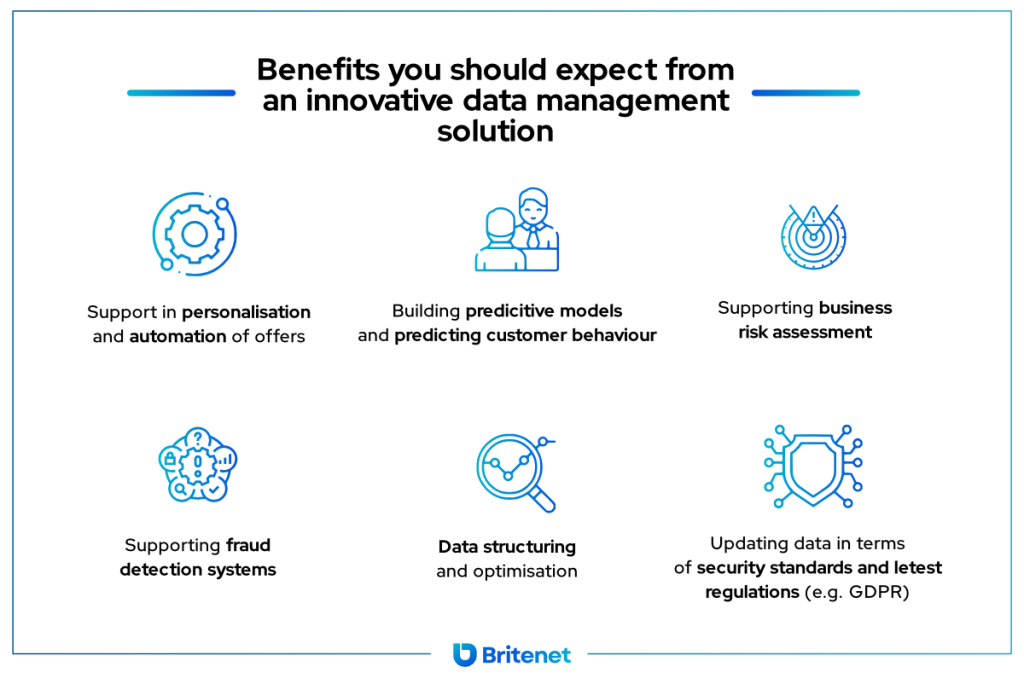

Many insurance companies experience difficulties in understanding their customers' needs. This, combined with a lack of effective tools to process large amounts of data, results in significantly longer customer service times. The use of NLP technology enables faster and more precise responses to queries and personalisation of services – resulting in greater customer satisfaction.

Is it possible for a chatbot not to annoy customers? Check out what our expert thinks about it!

How can NLP technology support your growth?

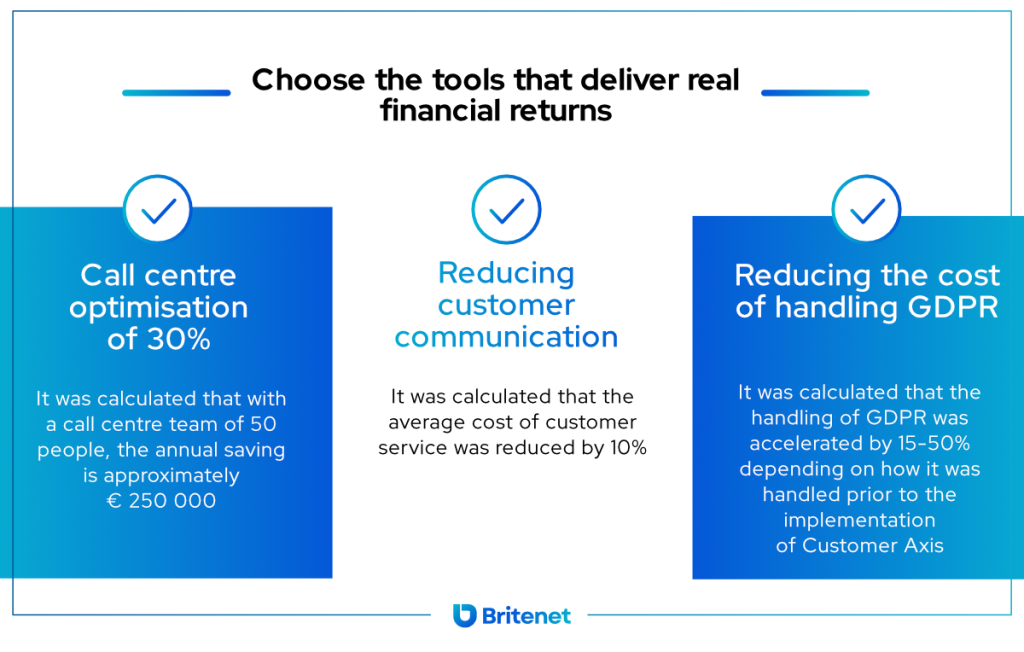

The integration of AI-driven digital assistants and NLP technologies is streamlining customer interactions and reducing operational costs for insurers. From underwriting to claims processing, these innovations facilitate smoother workflows, despite initial scepticism from some consumers about voice assistants. The integration of digital assistants and NLP technologies can streamline customer interactions, reducing call centre costs by as much as 30%. Furthermore, insurers can achieve significant efficiency gains, with potential savings of up to €1,000 per policy through automated customer support and query resolution.

Automated Underwriting: use AI to boost your profits

What is the main mistake of companies in the insurance industry?

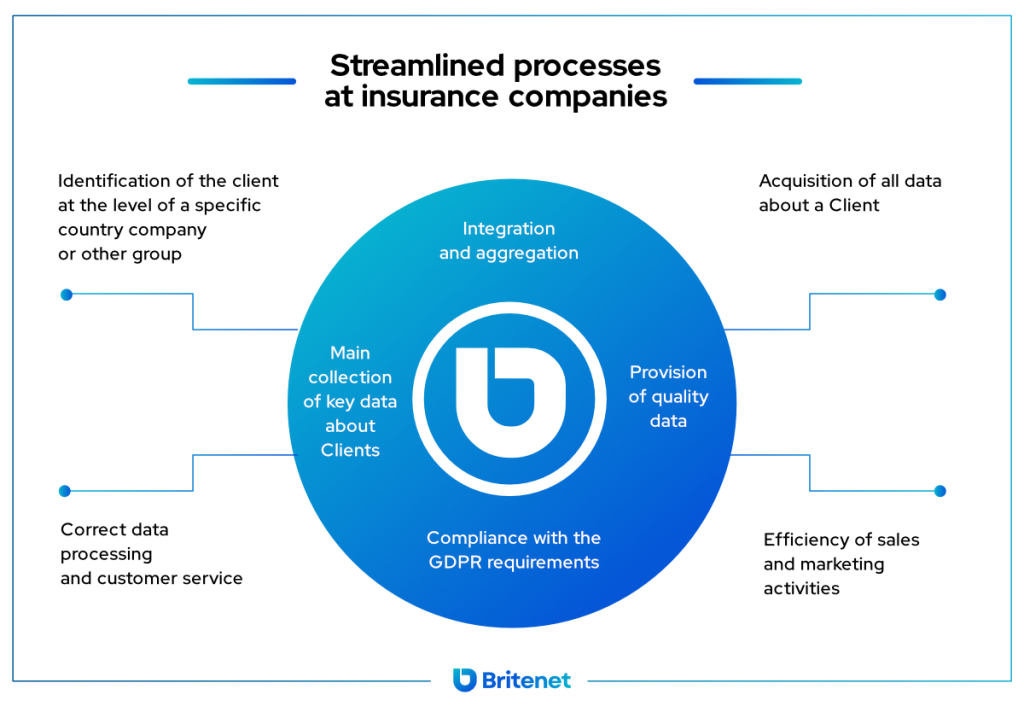

The main reasons for high operational costs and loss of competitiveness in the market are usually overly long decision-making processes, incorrect risk assessments and insufficient business opportunities – due to a lack of valuable data. Many companies in the insurance industry try to improve their situation by implementing multiple distributed solutions, introducing even more data inconsistency. By working with a trusted IT partner, insurance companies can connect and unify the data they have and start to benefit from the full potential hidden in the data.

Grow your business with automated underwriting

Robotic process automation RPA and AI-powered automated underwriting systems are simplifying risk assessment and policy issuance, resulting in significant time and cost savings. McKinsey estimates substantial potential value creation through AI investments across various insurance functions. Robotic process automation and AI-powered underwriting can dramatically reduce manual processing costs. Insurers stand to save up to €5,000 per month through streamlined underwriting processes, resulting in potential annual savings of hundreds of millions of euros for large insurance companies.

More effective fraud detection via Machine Learning

Protect your business with Machine Learning

Every year, insurance fraud costs European insurers and their consumers around €13 billion. Vulnerability to undetected information manipulation and document falsification means not only financial losses but also damage to a company's credibility and reputation. The answer to fraud is IT solutions that use Machine Learning algorithms.

Use Machine Learning to protect your business

Before you implement machine learning – 5 questions to ask yourself

Machine learning algorithms are proving to be effective tools in the fight against insurance fraud. By analysing vast datasets and identifying suspicious patterns, insurers can detect and prevent fraudulent activities more efficiently, thus safeguarding their financial interests and improving overall industry integrity. Implementing machine learning algorithms for fraud detection can yield substantial financial benefits. Insurers can prevent fraudulent claims worth millions of dollars annually, with studies suggesting potential savings of up to 20% of total claims paid out each year.

As someone deeply immersed in BI technology, I can't stress enough the importance of weaving together a tapestry of cutting-edge IT technologies like machine learning and natural language processing (NLP) and of course data warehouses or lakes in the insurance area, all while partnering with trusted IT allies. It's not just about upgrading systems; it's about sculpting the future of our industry. By synergizing these technologies, we're not just streamlining operations – we're uncovering new insights, managing risks smarter and truly connecting with our customers on a profound level. It's this harmony of innovation and collaboration that propels us forward with confidence, leveraging data warehouses as our foundation to navigate and thrive in the ever-evolving area of insurance.

Łukasz Nienartowicz – Head of Business Intelligence

Conclusion

Companies in the insurance sector are primarily hindered from dynamic growth by an inadequately prepared IT infrastructure. Many companies stop their growth on one system or opt for fragmented, incompatible solutions – guided by market trends when choosing them. As a result, instead of seeing the effects of the transformation, they have to count the losses resulting from the implementation of a mismatched system and plan the next IT project – which can repair the damage at one point and cause new ones in another.

The way to success and a secure position in the market is to be able to combine and use different technologies – to achieve a coherent and synergistic whole. This effect is achievable in collaboration with a trusted IT partner who strives to fully understand the needs and capabilities of the company and then presents optimal solutions tailored to specific goals and growth.